Groupon is in a bad strategic position and needs to quickly pivot. If it does, it might be the largest pivot we've seen in the Internet space. Groupon's cash base will enable the company to sustain for a little while, but we are witnessing a very rapid deterioration of its strategic advantages.

Groupon is a HBS strategy case study waiting to happen (if it hasn’t already). My personal take is that regardless of how the Groupon story ends, it is a rare breed of company. A billion dollars in revenue is a massive achievement. Of US consumer internet companies founded in the last 5 years, there has been only 2 (Zynga and Groupon) that have reached that scale of company—Facebook was founded 7 years ago.

What Groupon has also proved is that there is a massive advertising opportunity connecting local businesses and consumers—hence the hundreds of copy-cat daily deal sites.

Yet the market is proving that Groupon's assumptions about what is defensible in the local advertising space were wrong. Groupon made a bet on a strategy that focused on customer acquisition at massive scale and that its crazy big email list would provide it defensibility.

Once we have a customer’s email, we can continually market to them at no additional cost.

- Andrew Mason, Groupon CEO

http://allthingsd.com/20110825/exclusive-groupons-mason-tells-troops-in-feisty-internal-memo-it-looks-good/The thinking followed that by owning the biggest email list, Groupon would have a unique proposition to small businesses that they would be the only place where they could reach such a massive reach of customers so quickly.

Initially this was a unique value proposition, and Groupon leveraged this to obtain huge concessions from local businesses (50% of value of coupon sold). There began a virtuous cycle where Groupon had access to the best local business deals, thereby attracting more customers, increasing brand value, and making money hand over fist.

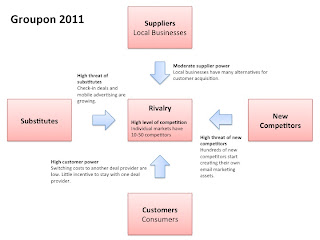

Breaking down Groupon’s strategic position using the Porter’s Five Forces model, you get this picture of the company around 2009:

- Groupon was exploiting low supplier power, which ultimately was a result of low competition.

- Customers loved Groupon, but still the ball was in the customer's court. The deal (Groupon's product) had to be really good. 20% off was not good enough...it had to be 50% off.

- New competitors were quickly sprouting. A lot of people said that it was too easy to copy Groupon's business. Groupon and its investors were on the side that it was not easy.

Fast forward 2 years, and this is the strategic position Groupon is in.

- Groupon has no strategic advantage. It's competitive advantages on supplier power and little competition have been significantly weakened by the entrance of hundreds of competitors and significant substitute products.

- Customers have proven themselves to be fickle. They are loyal only to the best deal.

- Suppliers don't value Groupon's reach as much as they previously did. The huge rush of customers have brought several local businesses to its knees because their operations could not scale.

- Groupon has tried to extend its model to new products (travel, goods, immediately redeemable coupons) and new locales (international) to counteract its customers' fickleness.

In retrospect, it now looks like Groupon scaled itself too soon. It had not established a sustainable, competitive advantage and its assumption that scale, in and of itself, would prove to not be a true strategic advantage.

Several folks, including Groupon's CEO, Andrew Mason, keep bringing up Amazon as an example of a company that scaled unprofitably before becoming a huge success. Yet few people have contrasted Amazon's huge initial investment in operations versus Groupon's huge initial investment in marketing. Amazon made a very large bet that by building the most operationally efficient backbone, it would have an advantage on all its competitors on a) price b) shipping time c) selection d) personalization and ultimately e) customer satisfaction. Groupon has made a very large bet on building a big email list.

Where does Groupon go from here?

Groupon needs to change course because it will find that all its initial investments in marketing will start to deteriorate in value.

Groupon's current largest asset is not its email list. It's its brand.

Its brand has immediate recognition with both customers and local businesses. What the company now needs to do is determine how it can provide something new to one or both constituents that no one else can.

Without knowing the internal operations of the company, its hard to say what other assets the company can take advantage of to pivot. But the faster the company makes this change, the better. Making this change as a public company is 10x harder than making the change as a private company.